(As featured in Risk Management Magazine) Conducting due diligence is standard protocol when considering whether to acquire or merge with another business. However, it is similarly important to...

7 Ways to Proactively Govern Your Business

There are reasons why new business owners form corporations, limited liability companies or other legal entity forms. Branding and credibility in the marketplace are of course important, but...

The “Dirty Dozen” Landmines Which May Be Hidden in Your Contracts

(As featured in Risk Management Magazine) If you have an agreement to do or not do something, and something of some value has been given in exchange for that something, then you likely have a...

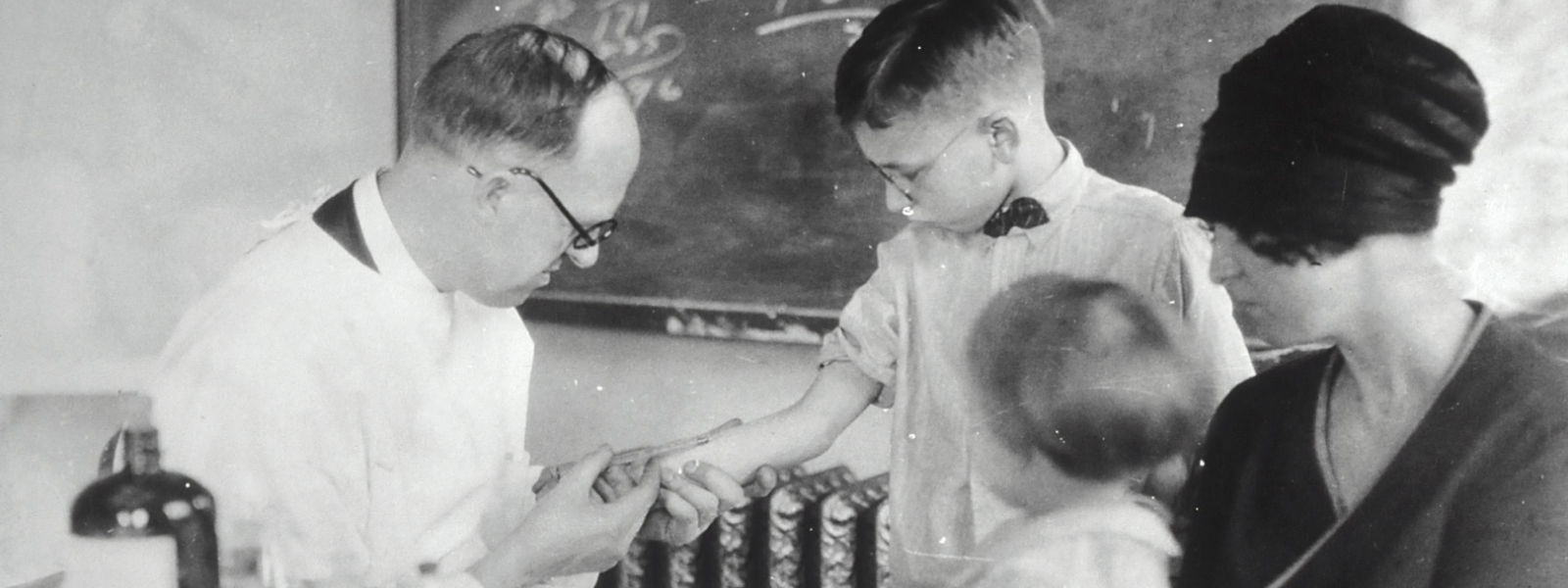

The Preventive Lawyer: A Business-Forward Generalist

“I’m not a pastry cook, but I’ve had to learn a certain amount about it. I’m not a baker, though I’ve had to learn how to do it. I’m sort of a general cook.” - Julia Child You’ve had shortness of...

KEEFER STRATEGY

We’re changing the way businesses approach law. As a trusted partner, we help you navigate the legal world so you can focus on what you do best.

UPCOMING EVENTS

Stay tuned to find out where Chris will be presenting in the new year!

Ounce of Prevention Tool

Ready to integrate Preventive Law into your business-decision making? Download our top five ways to begin.

Get Your Monthly Ounce of Prevention

Join our mailing list to receive the latest news and updates from our team on how you can leverage preventive law to protect and grow your business.

You have Successfully Subscribed!

Get Your Monthly Ounce of Prevention Insight

Join our mailing list to receive the latest news and updates from our team on how you can leverage preventive law to protect and grow your business.